By Liz Farmer | Senior Contributor

Sept. 23, 2021

This story was originally published on Forbes.com

Thanks to historic investment returns over the last year, state public pension plans are in their best shape since the Great Recession.

After state pension debt grew to more than $1.4 trillion last year, two new reports estimate that gap between the total amount states have promised to retirees and what they’ve actually set aside in their pension investment funds will shrink dramatically. A recent analysis by the Pew Charitable Trusts says the gap could dip below $1 trillion this year. And a report released today by the Equable Institute estimates that 2021 returns will shrink state pension debt to $1.08 trillion.

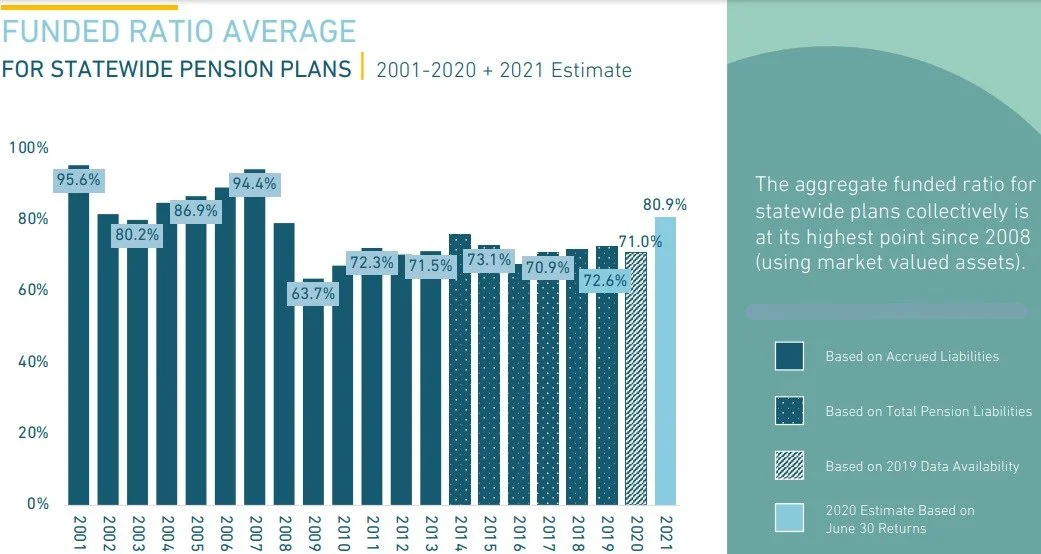

The gains in the stock market played a big role. Equable’s report calculates that preliminary 2021 investment returns averaged an astounding 20.7% return. That’s nearly triple the average assumed rate of return in any given year. Those gains will boost the average pension plan to about 80% funded, the highest funding ratio since 2008.

“The financial market volatility over the past 18 months of the COVID-19 pandemic has ultimately been a positive investment climate for institutional investors like state pension plans,” the Equable report says. “And the federal government has provided substantial financial aid to states and municipalities, smoothing over what could have been seismic budgetary shortfalls in some jurisdictions due to tax revenue declines.”

Statewide pension plan funding is at its highest level since before the Great Recession. | EQUABLE INSTITUTE STATE OF PENSIONS 2021 REPORT

While this is probably the most positive pension news we’ve had in a long time, it’s also not lost on anybody that $1 trillion is still a very large number. So it doesn’t mean taxpayers can stop worrying about whether their state’s pension health will cost them in the future.

What’s more, market volatility worked out this time around for pension funding, but that’s not always the case. In 2015 and 2016, bad economic news from China and more uncertainty around Britain’s decision to leave the European Union contributed to wild swings in the stock market. It resulted in pension plans reporting their worst investment returns since the Great Recession.

For taxpayers, this all means that there’s no guarantee that problematic pension funds are now on the road to recovery. They may still be asked to pay higher taxes or accept reduced services so that states can continue to put more money into their pensions down the road. State plans in places like Illinois, Kentucky, New Jersey and Pennsylvania are still woefully underfunded and have less than 60% of the assets on hand to pay for all the promised benefits. Kentucky’s state plan is in the worst shape — less than 20% funded.

On the one hand, these states have all made some difficult and even controversial policy changes over the past decade to make their pensions fiscally sustainable. None of these states were paying their full pension bills when the Great Recession hit, and they had to rectify that or risk the collapse of their funds. But on the other hand, that process has come at a huge cost. All four have collectively dumped more than $100 billion into their pension plans over the last decade, quadrupling their annual cost according to Pew.

Now that they’ve reached the point where they are paying their full bills, the question is can they sustain those payments? The same might be also asked of Alaska, Hawaii, Missouri and New Mexico, which Equable also points out also have pension debt that equals more than 15% of state GDP.

“There is a theoretical limit to the contribution rates that state leaders will want to have drawing from their general funds, school district funding, or city budgets,” Equable’s report says. “The larger a state’s unfunded liability relative to GDP, the harder it will be for that state’s tax base to pay down the pension funding shortfall.”

Still, there’s good reason to be optimistic about pension stability going forward. Many governments have had to take a hard look at the weaknesses in their plans following the Great Recession and are lowering their annual investment return assumptions. A decade ago, plans still assumed an average annual investment return of 8%. Most are now are lowering that target toward 6%, which is what economists and credit ratings agencies say is a more realistic goal.

Policymakers have also cut benefits for new hires which slows the growth of pension liabilities going forward and increases the odds that governments will be able to keep up on annual payments.